Two years ago my husband and I became the co-owners of EcoEnclose, a business that manufactures and distributes sustainable shipping solutions to eco-focused ecommerce businesses. Through my many years as a management consultant and then a food entrepreneur, my husband’s many years in finance and private equity, and our four combined years of business school, we had what felt like a very solid background from which to lead this company. In many ways we did—financial forecasting and budgeting, strategic planning, marketing and branding, developing innovative eco-friendly new products. But we’ve also been humbled by what we’ve learned, particularly about the day-to-day challenges of running a manufacturing, warehousing and distribution business. These experiences have given me a deeper appreciation for the challenging work of food hub operators, and I hope have made me a better advisor to the amazing clients I get to work with in my role at New Venture Advisors.

Here, I share five of my insights over the past two years that seem relevant for food hubs (which I recognize are so different from EcoEnclose in many ways!) in hopes that they give comfort to anyone also dealing with these issues every day, and added dimension and understanding to anyone who works with and supports food hub operators as part of their work.

Cash is king (but you can’t make it all you look at)

Planners spend a lot of time analyzing their historical profit & loss statements, and developing detailed forecasts. And these P&Ls are essential. I couldn’t run my business without them. But on a day-to-day basis, cash is what I look at. Paying vendors, paying employees, paying rent…all of this depends on how much cash I have in the bank. In any given week, cash could look very different from what my P&L says I should have depending on things like how much is in outstanding receivables or when my credit card is set to pay.

Business schools, consultants and managers at large companies typically focus on income statements as their primary measure of the success of an initiative or business. Yes, they may give a nod to balance sheets and cash flow, but it always seem that these are side exercises and not the main show. And what I’ve learned is that it is nearly impossible to forecast your cash flow accurately years in advance as part of a business plan. There are so many nuances like the date your credit card payment is due and vendor credit terms.

At the same time, I’ve learned that a lot of business owners don’t actually spend much time with their income statements. They just look at where their bank account is at the end of each month and use that as a proxy for their business’s health.

Which is right? As you probably guessed—neither. I’ve learned that the only way to get a true handle on my business and opportunity areas is to take the time to review my balance sheet, statement of cash flow and income statement in equal parts. My balance sheet shows me if my business is solvent. Do I have equity, and if so, how much? What is my cash position at the time, and how does that compare against my receivables and payables? My statement of cash flows helps me understand how well positioned my business is to cover bills as they come. Is my receivables versus payables schedule appropriate and reasonable? Am I ready for seasonal highs and lows I am about to encounter? My income statement will help me understand, Is the business sound and actually generating a profit, or—do I need to cut my cost structure, increase my pricing, or just drive as much new revenue as possible to make it all work?

Days are tremendously busy and it is tempting to skip the bookkeeping work that is needed to make these reports available, and then just as challenging to carve out the time away from the day-to-day to actually review and make sense of them. But skipping any part of this is a huge miss!

You don’t hire 0.28 of a person

And you don’t typically eliminate a warehouse worker during a single slow month. Basic financial forecasts will often tie warehouse labor to sales volume. This is a fine practice when you are looking to understand the financial viability of your business model. But when we’re actually planning headcount, it often looks a lot different. We hire on fairly set schedules or shifts—full-time at 40 hours per week or part-time for 20 hours per week. We don’t vary people’s hours day-by-day or even week-by-week based on sales. Not only isn’t this feasible for us operationally, it also isn’t at all fair to employees who need consistency in their schedule and compensation. Additionally, individual employees do (and should) ask for raises! Financial forecasts and planners typically assume standardized wages, applying annual COLA adjustments. But after a year, great employees will ask for and get a raise above and beyond COLA—making average warehouse wages rise above what may have been originally forecast.

All of this is to say that salary and wage forecasts are of course well researched numbers. But salary and wage realities are all about actual people, and they are much more nuanced, fluctuating and unknown than a spreadsheet can dictate.

Costs are often incurred before you modeled them

We needed a new machine to handle orders in the busy season. In a long-term forecast, I may have assumed I needed the machine the month of or month before the busy season. In reality, I may actually have had to acquire and begin financing it six months in advance to allow for installation, testing, training, etc. The same is true for staff. It often takes 2-4 weeks to train someone for a skilled position, so they need to be brought on well before our order volume actually calls for it. Time and again, we find that we have to incur fixed costs well in advance of our growth, and then work hard to achieve our forecast! This can mean our overall costs across a year are more than we would have anticipated via forecasting alone. It also means enduring the emotional burden and stress of bearing costs and anxiously working towards and hoping for the end results you planned for—phew, that is stressful!

There is no perfect software out there

I’ve spent a lot of time in my career helping companies and entrepreneurs find great software solutions for their needs. I’m now experiencing first hand what I always say to clients and hear, but hadn’t truly and deeply understood. Small to mid-sized businesses that aren’t in a position to invest massively in custom developed software will be extremely likely to find frustrations with their technology solutions. We rely on a host of technology providers for our ecommerce platform, bookkeeping software, inventory management, shipping management, social media management, etc. All of them are functional for our needs. We can get them up and running fairly quickly and they don’t need a lot of customization to work for us. They are “out of the box” and affordable. But all of them are also lacking. We are always wishing for new or better or just different functionality. We are constantly creating workarounds on spreadsheets and Google docs. Every few days there is a moment of “there has to be a better way!” But typically there isn’t. Or more accurately, there is, but the better way is not worth the time or money it will require given that we are a mid-sized (read: resource constrained!) packaging company and not a cash-rich behemoth or a technology company.

Remember why you do what you do

There is no better feeling than selling an actual, tangible product that you’re passionate about to customers you are equally passionate about. The work is tough emotionally, mentally and physically. Margins are slim. Maintaining seamless, error-free operations is a constant battle. Negotiating with vendors, especially in the face of commodity price increases, can be trying. Competing with massive players that have fully automated processes and over 50% market share can be deflating.

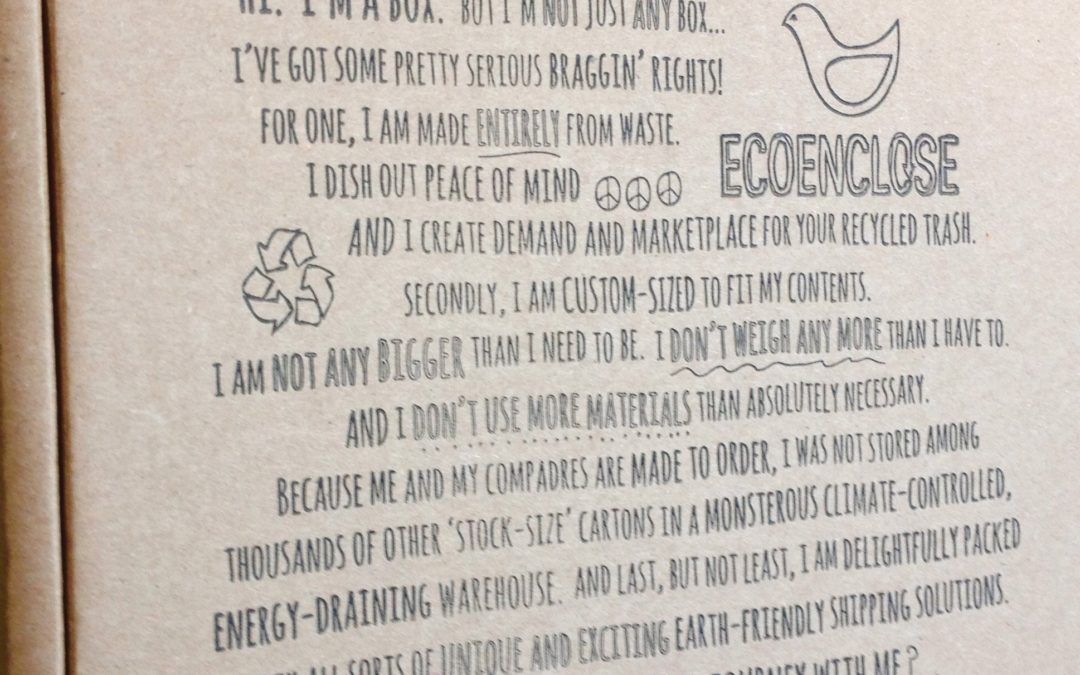

But, the thing is—we are pretty obsessed with our mission. We know that packaging is ubiquitous and wasteful. We know there are eco minded businesses that want to package their products more sustainably, in ways that align with their brand and values. We also know that the market for recycled products (and therefore the entire foundation of recycling and sustainable management) depends on companies like ours that are staunchly committed to using recycled material.

We are also obsessed with our customers. We serve almost ten thousand businesses that have a stated and authentic commitment to doing business better—more consciously, more ethically, more sustainably. It is easy to forget how passionate we are about what we get to do every day when we’re grinding it out.

I imagine food hub operators are similarly exhausted by their work but also obsessed with their mission, and the farmers and buyers they work with (even when those very suppliers and accounts might frustrate them so much!).

So we can’t forget to find the time to connect with the very people we get to serve and to put ourselves in touch with our mission on a regular basis. For me, this means talking to and reading about the awesome businesses we work with at least once a day. It means reading and writing about climate change and environmental progress. And as someone fortunate to live near the incredible outdoors of Colorado, it means getting to the mountains as much as possible.