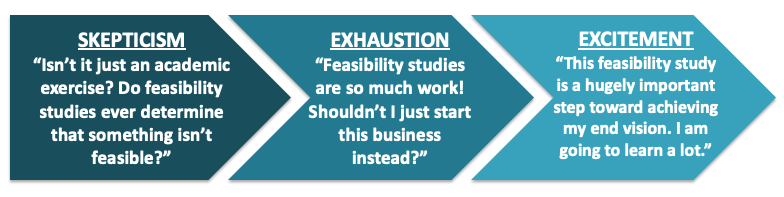

The term “feasibility study” seems to elicit a wide range of reactions ranging from skepticism to exhaustion to excitement.

Where along this spectrum someone falls can often depend on the structure and execution of a study, as well as the initial motivation of the team to pursue the study.

Feasibility studies for regional food enterprises constitute a large proportion of New Venture Advisors’ work. Since 2009, we’ve worked with over forty planning groups, nonprofits and private enterprises across the country. I am always surprised that each project is unique, with a distinct food landscape and a core team on the ground with different skills and motivations. Because we do not concentrate our work in any one area of the country, we are always learning about the individual hopes and concerns of producers and buyers in an area and continue to be inspired by the ambitions of local food systems leaders.

When we launch a new project and begin working with a new planning group, I am reminded of two things:

- The ideal frame of mind for a food enterprise feasibility study is curiosity – “I can’t wait to see what we learn about our food landscape, and what the data suggests about ways to connect producers with buyers.”

- In a successful study, the team on the ground is not just gathering data for analysis, but also using their outreach efforts to form foundational relationships for future food systems work. Awareness and connections between producers, buyers and other stakeholders is the social infrastructure that supports food system enterprises.

Over the past six years, our approach to feasibility studies has evolved significantly. We have taken cues for change from national food systems development work and from our collaborations with incredible local teams. While we do not believe in a “cookie cutter” approach to feasibility studies, we have learned that there are a few guiding principles that maximize the value of a study, ensuring it is an investigation that leads to a business decision and not an academic exercise that leads to a gorgeous report that never leaves the shelf.

- Set (and prioritize) the goals and vision for the enterprise early on: Regional food businesses are often social enterprises that have a myriad of tightly interconnected goals. However, delineating the top one or two goals at the start of a study is important as it sets the stage for the research strategy and the framework that will dictate the go/no-go decision. For example, is the primary goal to generate a competitive return on investment, to breakeven annually at steady state, or is the team comfortable with the enterprise losing money annually in order to achieve a social mission? Is healthy food access critical? Is the enterprise trying to help producers expand production or motivate growers to transition to sustainable practices? Clarifying these goals upfront will ensure that the right data can be collected during the research analysis phase of a study, so the team has the right evidence to make a decision. Conversely, if these goals are prioritized after the majority of research has been done and the analytical models have been built, a team could rationalize a “go” decision when it might not have been recommended on the basis of their goals at the outset.

- Keep an open mind about the structure of the business: A food enterprise can take many forms – a packing house, an online marketplace, a processing facility, a CSA aggregator, a food district, etc. It is helpful to avoid going into a study with a rigid notion of the operating model. We have seen success when teams allow the form and structure of an enterprise to emerge from the data regarding what producers and buyers need and what services and infrastructure already exist in an area. If you do have a vision for the operating model, it may help to write down and share your hypotheses to ensure they can be analyzed and the right data is collected to test them.

- Understand existing regional local food systems efforts: With over 300 food hubs nationwide, and many new operations launching each month – it is likely that there is an existing or emerging regional food enterprise near you. Innovative mainstream distributors are beginning to improve and expand their work connecting local farmers and buyers. And new nonprofits are emerging to support local producers or promote local sourcing among wholesale buyers. Learning about and making connections with these neighboring efforts is critical. Find out what these enterprises are focusing on (products, geography, services), avoid duplicating offerings to the same set of producers and buyers, and explore ways that a new food enterprise in your region can add new value and work in “coopetition” with these organizations. This practice is not just invaluable for local food systems development, but is also just good business sense. Some of the teams we work with are incredibly impressive in forging these collaborations.

- A study is only as good as the information gathered: We are often asked at the start of a project, “What do we need for a good feasibility study?” The answer to this question is simple: data. We need data from both regional producers and buyers regarding their interest in working with a new food enterprise, what products can be grown that are desired by buyers, what food safety and liability requirements are employed by growers and needed by buyers and where there may be excess capacity. The only way to capture the answers to these questions is through primary research – interviews, surveys, focus groups, etc. The data alone will not accurately convey whether a venture is feasible for an area, but the “journey” to the data often reveals strategic insights and relationships. The hard work of setting up interviews, fielding surveys or arranging focus groups requires a combination of community organizing activities, cold calling gumption and networking skills. These important steps allow a team to both build the network and gain the perspective needed to launch a successful food systems development project.

- Build a strong, diverse, committed team of stakeholders, decision makers and supporters: Assembling a steering committee and/or advisory board is a critical way to ensure that a broad and large group of producers and buyers will be engaged with the study. These groups should include representative and well connected growers, representative buyers who are passionate about local food, farm bureau and/or extension agency representatives, leaders of relevant associations and media outlets (i.e. farm to institution groups, Slow Food, etc), and funding agencies that might ultimately help get a food enterprise off the ground. This group plays four critical roles: 1.) solidify the goals and vision for the proposed enterprise, 2.) verify that the work plan and the research instruments are highly effective, 3.) help to cast a wide net that engages a large group of buyers and producers in the primary research elements of the study, and 4.) ensure that strategic and data-driven go/no-go and next step decisions are made.

- Reposition what “no-go” would mean: A no-go decision – especially after you’ve galvanized a community of producers and buyers and begun to dream about warehouses, pallets stacked high with produce and reefer trucks – can be a huge disappointment. Before you even launch a study, brainstorm a few alternative next steps if the study results in a “no-go.” For example, if you find that demand is low, you might consider engaging in brand and market development work, or engaging organizations that promote and incentivize institutional local purchasing. If you find that production is low or that growers are not wholesale ready, you might work with local agencies that can support these producers in expanding and evolving their operation. If you find that there is a big mismatch between the type of products buyers want and what growers are producing, perhaps you will explore strategies to encourage a series of preseason production planning discussions between growers and buyers. Obviously, the next steps you ultimately take with a no-go decision would be developed based on the data – so this is very much an initial brainstorm. But taking this step can be a helpful reminder that a no-go is not the same as “do nothing.” It is a signal to redirect efforts to other strategies to achieve your primary goals.

If you are launching a regional food enterprise feasibility study effort and/or thinking about applying for a grant to fund this type of study, you may find it helpful to complete this worksheet. It is designed to help you reflect on the lessons and suggestions above. Share your reflections with the broader team, and it may spark discussion that will strengthen the way you frame your project plan and present your ideas in grant applications.

If we can help you get your study off on the right foot or help you think through a proposed study approach for a grant application, we’d love to chat. Click here to set it up!